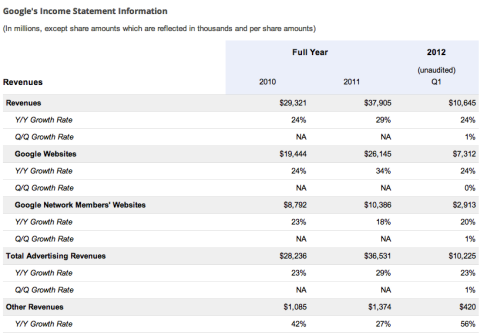

Although it was its innovation that made Google the number one search engine, the company did not make a dime until they started auctioning ads that appear alongside the search results. Today, advertising accounts for 99% of the companies revenue whose market capitalization now tops $100 billion.

Research is now say that Google’s auction method, which was invented internally, was key to their success. In fact the AdWords became so successful that some of its key feature were quickly adopted by top competitor Yahoo!, the then search-ad leader; they give the top spot in its search results page to the advertiser who pays the most per click. However, Google maximizes the revenue it gets from the “real estate” by giving the best position to the advertiser who is likely to pay google the most in total, based on price per click multiplied by Google’s estimate of the likelihood that someone will actually click on the ad. As a result, it is estimated that Google earns about 30% more revenue per ad impression that Yahoo does.

What makes Google’s auction so different? Normally, bidders always have the incentive to tell the truth. However in Google’s auction, they don’t. By understanding the top price, they are willing to pay, advertisers could get a slightly lower position on the search page for a lot less money. They concluded that naive advertisers who told the truth could overbid. The system also has pluses for advertisers too. I’m not sure it gets more innovative then this.

http://www.businessweek.com/magazine/content/06_10/b3974071.htm